Card Account Terms

(With effect from 6 November 2025)

These Card Account Terms (“Terms”) set out the terms and conditions that govern the relationship between GXS Bank Pte. Ltd. (the “Bank”, “us”, “we” or “our”) and the customer (“you” or “your”) and the services and products that we provide to you under these Terms. The Bank agrees to provide you with the services or products that you have applied for, and for which we have approved your application.

Section A (General Terms and Conditions) sets out the terms and conditions (the “General Terms”) that apply generally to the services and products that the Bank provides to you under these Terms.

In addition, specific terms and conditions (each referred to as “Specific Terms”, and collectively referred to as the “Specific Terms”) will apply to the provision of specific services and products by the Bank to you. When the Bank introduces or agrees to provide you with new services or products, the Bank will inform you of the relevant Specific Terms that apply to the provision of such new services or products, and you agree that the relevant Specific Terms will apply to the provision of the relevant new service or product by the Bank. The Specific Terms are part of these Terms. If there is any inconsistency between the General Terms and the Specific Terms, the Specific Terms will prevail to the extent of such inconsistency.

A. General Terms and Conditions

1.1 To open any account with the Bank or use any service or product of the Bank, you:

- must meet such requirements that the Bank may specify from time to time, generally or in relation to any specific service or product;

- agree that the Bank may retrieve your personal information from the Myinfo platform maintained by the Singapore government; and

- agree to provide the Bank with any information or document that the Bank asks for from you in such form and manner required by the Bank from time to time.

1.2 The Bank shall have the right, in our discretion, to approve or reject any application to open any account with the Bank, or to use any service or product of theBank, without giving any reasons and shall not be liable for any Loss that maybe incurred as a result.

2.1 Instructions to the Bank must be given in writing (through any means specified and accepted by the Bank, including electronic means), or any other means permitted by the Bank.

2.2 You may authorise another person (an “Authorised Person”) to give instructions to the Bank and operate your account on your behalf. You may apply for another person to be an Authorised Person by providing us with the details of such person in the manner specified by us. Your appointment of an Authorised Person is subject to our approval and such conditions (including providing any indemnity in favour of the Bank) specified by us. If we approve your appointment of an Authorised Person, you will ensure that such Authorised Person is aware of and complies with these Terms. The Bank is under no obligation to enquire as to the purpose for which any authority granted to any Authorised Person is exercised or whether any Authorised Person is doing so in good faith.

2.3 The Bank will not act on any instruction other than an instruction from you. The Bank is entitled to act and rely on any instruction that it reasonably believes to come from you. If we request for information, evidence of your identity or authentication before acting on any instruction, you shall promptly provide such information, evidence or authentication. Notwithstanding this, we may act and rely on any instruction without requesting for evidence of your identity or authentication.

2.4 Where any instruction is given through any means that require you to use a password or PIN to access an application or other system before giving such instruction or to provide an authentication code, you agree that the use of such password, PIN or authentication code is evidence that the instruction comes from you and is authorised by you. You must safeguard the confidentiality of your password, PINs and authentication codes.You must not disclose any password, PIN or authentication code to any person or keep a record of your password, PIN or authentication code in any matter that enables another person to misuse your password, PIN or authentication code. If you know or suspect that your passcode, PIN or authentication code has been compromised, you must immediately change your password, PIN or authentication code and notify the Bank.

2.5 The Bank may request you to provide additional confirmation before acting on any instruction. Notwithstanding this, we may act and rely on any instruction without requesting for such additional confirmation.

2.6 The Bank is not responsible or liable for any Loss that you may incur as a result of us acting on any instruction that was not authorised by you or did not come from you, unless such Loss is caused by our gross negligence, wilful misconduct or fraud.

2.7 You are responsible for ensuring that your instructions are given on time, and are accurate, clear and complete. The Bank may request confirmation, clarification or further information from you before acting on any instruction. We will not be responsible or liable for any Loss you may incur as a result of your instructions being late, inaccurate, unclear, inadequate or incomplete, or any time taken for us to confirm or clarify your instructions, unless such Loss is caused by our gross negligence, wilful misconduct or fraud.

2.8 The Bank shall have the right, but is not obliged, to not act on any instruction, or to carry out checks before acting on any instruction, if:

- we reasonably believe the instruction to be not authorised or to have not come from you;

- the instruction is unclear or incomplete, or we receive conflicting instructions;

- we reasonably believe or have reason to suspect that your account may or appears to be compromised or any unauthorised transaction may be or appears to have been made;

- you do not provide any information, document, authentication or confirmation requested by us;

- we believe that you lack the mental capacity to give us instructions or operate your account;

- there are insufficient funds in your account, or if any instruction may result in your account being overdrawn or having a negative balance;

- doing so may result in a breach of any Applicable Law (including any Applicable Law relating to anti-money laundering, countering the financing of terrorism or sanctions), or if we are prohibited by any Applicable Law or any court order or any direction from any regulator from doing so;

- any event or circumstance that is not reasonably within our control prevents us from doing so; or

- there is any other reasonable ground for us to do so, including any ground on which we have a right to freeze or suspend your account under Clause A10 (Rights of the Bank) or if any Event of Default has occurred.

The Bank will not be responsible or liable for any Loss that you may incur as a result, including from any delay in carrying out your instructions, unless such Loss is caused by our gross negligence, wilful misconduct or fraud.

2.9 Instructions once given cannot be cancelled or reversed and are binding on you, unless the Bank agrees otherwise.

3.1 The Bank will periodically make available to you statements of account, confirmation advice, transaction records or other documents (“Statements”) setting out particulars of your accounts and transactions. The Bank may also send you notifications or alerts of transactions (“Notifications”) for your account, regardless of the value of the transaction.

3.2 You are responsible for checking your Statements and Notifications of transactions for errors or unauthorised transactions, and to verify the accuracy and completeness of the details in your Statements and Notifications. You must ensure that you are able to receive Statements and Notifications on a real-time basis on any of your devices used to receive any notification alerts from us (whether in Singapore or overseas), opt to receive Notifications for all outgoing payment transactions (of any amount that is above the transaction notification threshold), and you must check any Statement or Notification immediately once you receive it.

3.3 You must read the contents of the notifications (including any risk warning messages contained therein) which are sent by us containing your password, PIN or other security code and verify that the stated recipient or activity is intended prior to completing all activities using your account (including all payment transactions or high-risk activities). If you do not understand the risks and implications of performing high-risk activities, you should access our website or mobile application for more information on these activities or contact us prior to performing these activities. You are deemed to have understood, agreed to and accepted the risk and implications of undertaking any high-risk activities once you proceed to perform the high-risk activity.

3.4 We will be entitled to treat the details set out in the Statement or Notification as correct and accurate, and the relevant transaction as authorised by you, if you do not notify us of any errors or unauthorised transactions, or otherwise object to any details set out in your Statement or Notification within seven (7) days of the date of such Statement or Notification.

3.5 The Bank shall have the right, but is not obliged, to rectify any errors or omissions in any Statement or Notification.

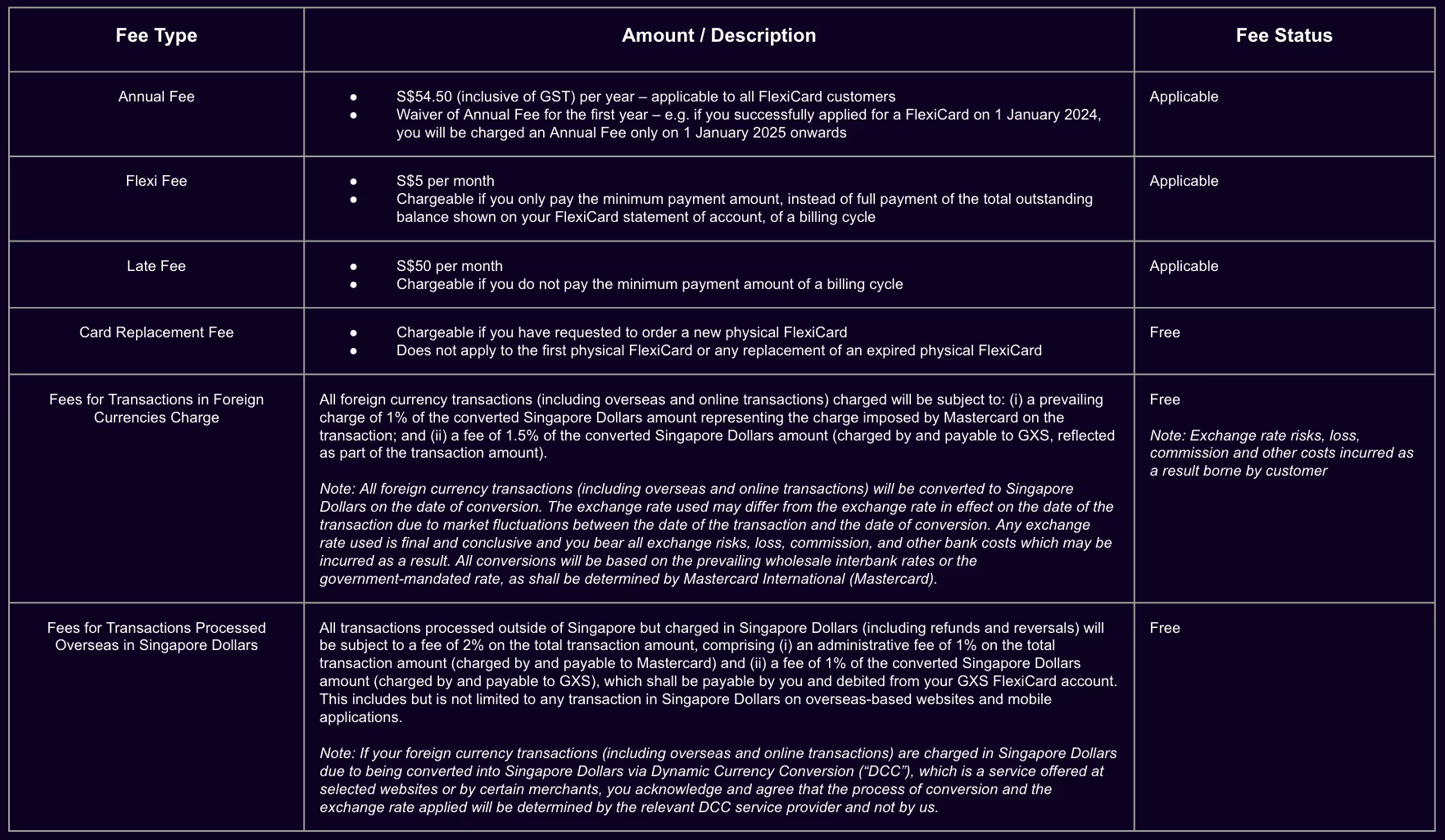

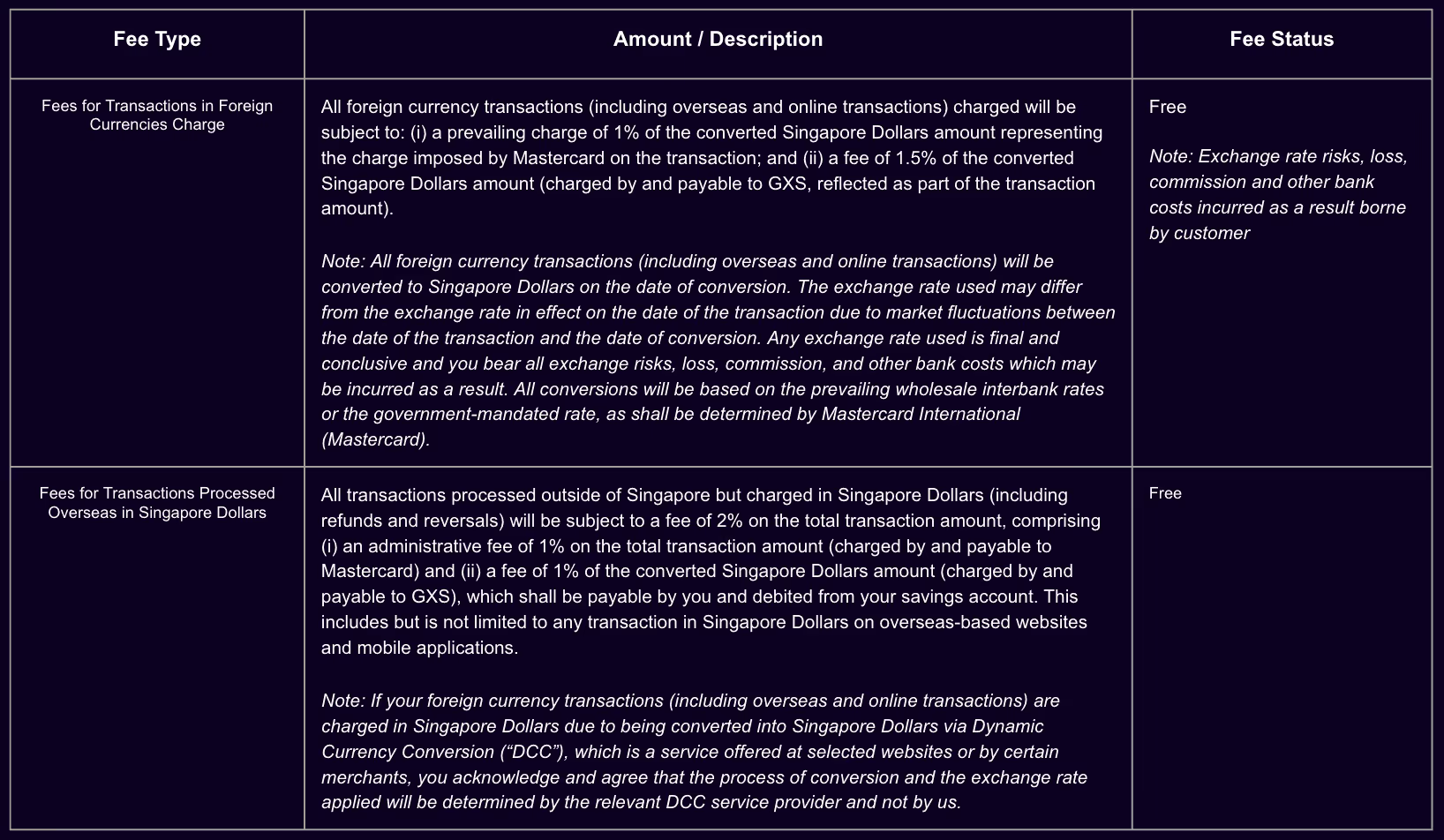

4.1 The Bank may impose fees and charges for the provision of our services or products, and has the right to change the amount of such fees and charges. TheBank’s fees and charges will be set out in a fee schedule notified to you from time to time. The fee schedule is part of these Terms. If there is any inconsistency between these General Terms and the fee schedule, the fee schedule will prevail to the extent of such inconsistency.

4.2 In addition, you agree to pay the Bank for any expenses, taxes or other charges that the Bank may incur in providing you with any product or service. Where possible, the Bank will notify you in advance of any such expenses, taxes or charges.

4.3 You will pay the Bank such fees, charges and expenses promptly.

4.4 The Bank has the right to deduct such fees, charges and expenses from your account, or through any other means in our discretion.

5.1 You agree and consent to the Bank disclosing your Customer Information to:

- any person whom the Bank believes in good faith to be an Authorised Person or upon your death or mental incapacity, your legal representative or your family member or beneficiaries;

- any Related Entity of the Bank;

- our agents, advisers (whether professional or otherwise), auditors, service providers, contractors (including sub-contractors and any further indirect sub-contractors who may be engaged by a contractor or another sub-contractor), whether in or outside Singapore (including cloud storage providers, service providers who carry out background, anti-money laundering and other checks, marketing service providers, data analytics providers, research partners and debt collectors);

- any other bank, correspondent bank, broker, insurer, provider of credit protection, fund manager, financial institution, card association, financial market infrastructure or any other third party for the purposes of and in connection with the provision of services or products to you;

- any payment system operator, payment institution or any other party for the purposes of and in connection with a funds transfer or payment transaction (including the other parties to a funds transfer or payment transaction, payment processors, payment intermediaries, payment networks, card associations, banks and other financial institutions) and their respective service providers, contractors and agents;

- credit bureaus, alternative credit scoring agencies and any other credit reporting organisations;

- any government authority, regulator, enforcement agency, tax authority, court, tribunal or judicial body;

- any person to whom the Bank is required to disclose information under Applicable Law;

- our business partners, such as Singtel and Grab;

- any person for the purposes of, or in connection with, any legal action contemplated or taken against you or in connection with the provisions of services or products to you;

- any person to whom we assign or transfer (or may potentially assign or transfer) any of our rights or obligations under these Terms;

- any person with which the Bank is entering (or is proposing to enter) into a transaction for the sale or transfer of any part of its business or assets, or any merger, acquisition or other corporate transaction, and any legal or professional advisers and consultants appointed by any party or potential party to any such transaction;

- any person referred to in the Data Privacy Policy;

- any person as notified by the Bank to you from time to time; or

- any person to whom we are permitted to disclose your Customer Information under the Third Schedule to the Banking Act 1970 of Singapore or any other Applicable Law.

5.2 This Clause A5 (Disclosure of your Customer Information) does not constitute an express agreement by the Bank for a higher degree of confidentiality than that prescribed in section 47 of the Banking Act 1970 of Singapore.

5.3 This Clause A5 (Disclosure of Your Customer Information) shall survive the termination of these Terms.

6.1 You agree and consent to the Bank or any of our officers, employees, agents, service providers and contractors (including subcontractors and any further indirect sub-contractors who may be engaged by a contractor or another sub-contractor) collecting, using, processing and disclosing the Personal Data provided by you in accordance with the Data Privacy Policy, which is incorporated by reference to this Clause A6 (Personal Data), and sets out:

- what Personal Data we collect;

- how Personal Data is collected;

- your representations with respect to Personal Data of third parties;

- what we use Personal Data for;

- who we disclose Personal Data to;

- overseas transfers of Personal Data;

- use of cookies and related technologies;

- protection of Personal Data;

- retention of Personal Data;

- your rights with respect to your Personal Data;

- amendments and updates; and

- how to contact us if you have any queries about the Data Privacy Policy or would like to exercise your rights as set out in the Data Privacy Policy.

7.1 You represent and warrant that the following are true and accurate at the time you first open any account with the Bank or use any service or product provided by the Bank, and on a continuing basis:

- you have full power, authority and capacity to enter into these Terms, to enter into any transactions with or through the Bank, and to perform and comply with all your obligations under these Terms;

- you have obtained all necessary authorisations and taken all other actions necessary for you to enter into these Terms and to be able to perform and comply with all your obligations under these Terms;

- your obligations under these Terms are valid and legally binding, and these Terms are enforceable against you;

- any information or documents that you provide to us, including your personal information on and from the Myinfo platform, are true, accurate, complete and not misleading;

- you have read and understood the Data Privacy Policy;

- you consent to, and have obtained all necessary consents for, the collection, use, processing and disclosure of all Personal Data that you or your representatives provide to us as set out in these Terms or the Data Privacy Policy;

- you will not be in breach of any Applicable Law or any contract, agreement or other document by entering into these Terms or obtaining any services or products from us;

- you are not involved in any unlawful activity, and you have not committed or been convicted of any tax, money laundering, terrorism financing or other criminal conduct, and you are not involved in any sanctioned activities or the subject of any sanctions;

- you are not a citizen or resident of any jurisdiction where we are not permitted to provide you with services or products;

- you are acting as a principal for your own benefit, and you are not acting on behalf of any other person, whether as trustee, agent, nominee or otherwise; and

- there is no Event of Default occurring.

7.2 You agree and undertake that you will:

- immediately inform us of any changes to your personal particulars, including any change in citizenship, tax residency, address(es) on record and taxpayer identification numbers, contact details or any other information or documents that you provided to us;

- immediately inform us if any of the representations and warranties set out in Clause A7.1 are no longer true or accurate;

- comply with all Applicable Laws, including tax laws and laws relating to anti-money laundering, countering the financing of terrorism and sanctions, and user protection duties;

- not use the services and products of the Bank for any unlawful purpose, or that may involve a breach of any Applicable Law (including any Applicable Law relating to anti-money laundering, countering the financing of terrorism or sanctions);

- check your Statements and Notifications immediately once you receive them, and notify us immediately of any errors or unauthorised transactions. You shall report all unauthorised transactions or activity in relation to your account to us as soon as practicable, upon becoming aware of the same, and in any event, no later than 30 calendar days after the date of receipt of the relevant Notification in respect of that unauthorised transaction or activity (including but not limited to any payment transaction, high-risk activities or the activation of any digital security token). The report shall be made via such channels as we may designate from time to time for such incidents. You agree to provide us with any information that we request to facilitate our investigations into the transactions, and to make a police report as soon as practicable if we request such a report to be made to facilitate the claims investigation process. You shall provide us with the police report within three (3) calendar days from the date of our request. If there is any delay in your informing us of the error or unauthorised transaction, you must explain to us the reasons for such delay. In addition, if you suspect that you are a victim of scam or fraud, you should make a police report as soon as practicable regardless of whether there are any unauthorised transactions at the time of such discovery by you. You should cooperate with the police and provide evidence, as far as practicable;

- not share your password, PIN or other security code with any other person, and immediately inform us if you suspect that your password, PIN or other security code has been compromised. You agree to safeguard the confidentiality of your password, PIN and other security codes and not to keep a record of your password, PIN or other security codes in any matter that enables another person to misuse your password, PIN or other security codes. If you keep a record of your password, PIN or other security code, you must do all that is necessary to keep the record in a secure electronic or physical location accessible or known only to you, and keep the record in a place where the record is unlikely to be found by a third party;

- at the minimum, where any smartphone or other device is used to access the services or products provided by the Bank, only download our mobile application from official sources, ensure that our mobile application is updated to the latest version available, patch the device’s operating systems with regular security updates provided by the operating system provider, install and maintain the latest anti-virus software on the device (where applicable), use strong passwords (such as a mixture of letters, numbers and symbols) or strong authentication methods made available by the device provider such as facial recognition or fingerprint authentication methods, not root or jailbreak the devices used, and not download and install applications from third-party websites outside official sources (“sideload apps”), in particular unverified applications which request device permissions that are unrelated to their intended functionalities;

- activate the self-service kill switch function provided by us via such channels as we may make available from time to time to block further digital access to your account and our services or products as soon as practicable after you have been notified by us of any unauthorised transactions and you have reason to believe that your account or access to your account has or appears to have been compromised or if you are unable to contact us for whatever reason;

- only refer to official sources to obtain the website addresses and phone numbers of the Bank and contact us using such contact details.

7.3 The Bank will not request for your personal particulars, password, PIN or other security code through SMS, e-mail or Quick Response ("QR") codes. You are responsible for safeguarding the confidentiality of your personal particulars, password, PIN and other security code. You must verify and agree to exercise caution with any hyperlink in any SMS, e-mail or QR codes claimed to be sent by the Bank, unless you are expecting to receive information on the Bank’s services and products via these links or QR codes from the Bank.

7.4 You are hereby notified of and shall comply with your user protection duties under Section 3 of the E-Payments User Protection Guidelines issued by the Monetary Authority of Singapore (“MAS”), as amended from time to time, which is available on MAS’ website. Our corresponding duties are also set out in Section 4 of the E-Payments User Protection Guidelines.

8.1 The services and products provided by the Bank are non-exclusive, and you agree and consent to the Bank providing the same services and products to other customers of the Bank.

8.2 You agree that (a) the Bank may introduce you to Grab, Singtel and our other business partners, who may recommend their services and products to you and otherwise collect, use, process and disclose your Personal Data as set out in the Data Privacy Policy, or (b) you may have been introduced to us by Grab, Singtel or our other business partners. You agree that we may receive or pay a referral fee or commission from or to such business partner for such introduction.

9.1 You agree that the Bank may engage third party service providers, contractors (including sub-contractors and any further indirect sub-contractors who may be engaged by a contractor or another sub-contractor) or agents for the purposes of, and in connection with, the provision of services or products to you.

10.1 The Bank shall have the right to decide whether to approve your application to obtain any services or products from the Bank, and whether to provide you (or continue to provide you) with any service or product. In addition, the Bank shall have the right to withdraw the provision of, or change the manner in which we provide you with, any service or product at any time in our discretion.

10.2 The Bank shall have the right, but is not obliged to, to record any of our telephone conversations or video conferences with you, or any other verbal instructions or communications from or with you. You agree that we shall have the right to use the recordings in the event of any dispute. We are not obliged to provide you with a copy of any such recordings.

10.3 The Bank will retain records of your Customer Information to comply with Applicable Laws and for business and operational purposes. Our records shall be conclusive evidence of the contents set out in the records, including details of your accounts and transactions. We may destroy or cease to maintain any records where we are no longer required to do so under Applicable Laws, and you agree that we are not obliged to retain any records after the record retention period under Applicable Laws has ended.

10.4 The Bank shall have the right to take any steps reasonably necessary to comply with any Applicable Law, court order or direction from any regulator. The Bank shall have the right not to do anything under these Terms or in connection with the provision of services or products to you, if doing so shall result in a breach of Applicable Laws, any court order or any direction from any regulator. The Bank shall not be responsible or liable for any Loss that you may incur as a result of any such actions of the Bank.

10.5 The Bank shall have the right to freeze, suspend, block, close or terminate any or all of your accounts maintained with us or any provision of services or products to you if:

- you have a zero or negative balance in your account;

- you do not provide any information or documents requested by us;

- any representation or warranty in Clause A7.1 is not true or accurate or is no longer true or accurate;

- we reasonably suspect that you are involved in any unlawful activity, including any breach of Applicable Law (including any Applicable Law relating to anti-money laundering, countering the financing of terrorism or sanctions);

- we are required to do so by any government authority, regulator, enforcement agency, tax authority or any other authority;

- we are required to do so under a garnishee order, Mareva injunction, or other similar court order, or any order of any court, tribunal or judicial body;

- in our opinion, any account, product or service provided by the Bank is not being used in a lawful, proper or regular manner;

- any Event of Default has occurred;

- we have reasonable grounds to believe that you are not likely to be able to repay any amount or liabilities that you owe to us, or otherwise to perform any of your obligations to us under these Terms or otherwise; or

- there is any other reasonable ground for doing so or the Bank deems fit in its absolute discretion.

The Bank shall not be responsible or liable for any Loss that you may incur as a result of any such actions of the Bank.

10.6 In the event that your account remains inactive or dormant for such period of time as the Bank may determine, the Bank shall have the right to impose such conditions in relation to the further operation of the account as we may determine in our discretion. The Bank shall not be responsible or liable for any Loss that you may incur as a result of any such actions of the Bank.

10.7 The Bank shall have the right, but is not obliged, to reverse or cancel any transaction and make any corresponding debits from or adjustments to your account, without prior notice to you or without your prior consent:

- to correct any mistake or error, including where we have made a mistake or error in crediting your account;

- where we are required to do so under any Applicable Law, any court order or any direction from any regulator; or

- if we have any other reasonable ground for doing so.

In particular, the Bank is not obliged to reverse or cancel any transaction, or make any corresponding debits from or adjustments to your account or the account of any other person, to correct any mistake or error made by you or a third party.

10.8 Certain of our services or products may be temporarily unavailable for certain periods of time to facilitate maintenance of our systems. Where possible, the Bank will notify you in advance of any such periods of temporary unavailability.

10.9 This Clause A10 (Rights of the Bank) shall survive the termination of these Terms.

11.1 Any payment you make to the Bank shall be made in freely available funds in Singapore dollars or such other currency specified by the Bank, without any set-off or counterclaim, or any withholding or deduction of any taxes, charges or other duties.

11.2 If any withholding or deduction is required to be made under any Applicable Law, you agree to pay us an amount equal to the amount withheld or deducted such that the Bank receives a net amount equal to the amount which we would have received if no such withholding or deduction had been made.

11.3 If any taxes, charges or other duties are payable on any payment that you make to the Bank, you shall pay us an additional amount equal to the amount of such taxes, charges or other duties.

11.4 If you do not make any payment to the Bank on time, the Bank shall have the right to charge you default interest on the overdue amounts that are outstanding at a rate determined by the Bank and notified to you.

11.5 This Clause A11 (Payments) shall survive the termination of these Terms.

12.1 If the Bank receives any payment from you or on your behalf, executes any transaction for you or on your behalf, or you owe any amount to us, in a currency other than Singapore dollars (or a currency other than the currency in which payment is due), we may convert the amount denominated in the foreign currency (or such other currency than the currency in which payment is due) into Singapore dollars (or the currency in which payment is due) at the prevailing foreign exchange as determined by us. If we incur any costs or expenses in making such currency conversion, you agree to pay us for such costs or expenses.

12.2 Where any currency in which any of the Bank’s payment obligations is denominated becomes unavailable due to the imposition of currency exchange controls or restrictions, other governmental action, extreme volatility in the foreign exchange markets, or any other event or circumstance that is not reasonably within our control, the Bank shall have the right to convert the amount to be paid into another currency at the prevailing foreign exchange rate as determined by us.

13.1 The Bank shall have the right to retain and not repay you any amount which it holds for you in any account, or to withhold any payments due to you, if there is any outstanding amount you owe to the Bank, if you have any other outstanding liabilities to the Bank, or if the Bank has placed a hold or set aside any amount in any of your accounts for any reason.

13.2 All your funds in your accounts with the Bank are subject to a banker’s lien in our favour. We may apply the lien as security for any amount you owe to the Bank or any other outstanding liabilities you owe to the Bank.

13.3 Without limiting our rights under the banker’s lien above or any other rights we may have under these Terms or otherwise, the Bank and any of our Related Entities may, at any time and without any prior notice to you, set-off any balance in your accounts with the Bank and any amount that we or any of our Related Entities owe to you, against any amount that you owe to us or any of our Related Entities, or debit any of your accounts with the Bank or any of our Related Entities with any such amount that you owe to us or any of our Related Entities. The Bank and our Related Entities may also combine or consolidate all your accounts held with us or any of our Related Entities.

13.4 The Bank may exercise our rights under this Clause A13 (Right of Set-Off and Lien) at any time, regardless whether an Event of Default has occurred and whether your account has been closed or whether these Terms have been terminated.

13.5 You must not create any security interest or any other encumbrance over your accounts with the Bank, any funds or assets in your accounts with the Bank, or rights or obligations vis-a-vis, the Bank without our prior written consent.

13.6 This Clause A13 (Right of Set-Off and Lien) shall survive the termination of these Terms.

14.1 The Bank does not provide any advice on tax, accounting, insurance, legal, regulatory or environmental matters. If you need such advice, you should seek advice from your own independent advisers.

14.2 The Bank does not act as your agent, trustee or fiduciary in providing services or products to you.

15.1 The Bank shall not be liable for any Loss that you may incur in connection with or arising from our provision of services or products to you, unless such Loss is caused by our gross negligence, wilful misconduct or fraud. Without limiting the generality of the above, and without prejudice to any other provision of these Terms, the Bank shall not be liable for any Loss that you may incur:

- arising from us acting on any instruction that we reasonably believe to have been authorised by you, or to have come from you or to have been given on your behalf;

- any omission or delay in carrying out your instructions, unless such omission or delay is due to our gross negligence, wilful misconduct or fraud;

- as a result of the Bank taking any steps reasonably necessary to comply with any Applicable Law, court order or direction from any regulator or taking any other action in accordance with our rights under these Terms;

- where the provision of services or products to you is affected by any event or circumstance that is not reasonably within our control, regardless of the duration of such event or circumstance;

- where there is any unauthorised use or access of any smartphone or other device used to access the services or products provided by the Bank, or any such smartphone or other device is lost, misplaced or stolen;

- where your password, PIN or other security code is compromised or misused by another person; or

- arising from any unauthorised transaction, where you did not report to us promptly upon becoming aware of the unauthorised transaction in accordance with these Terms, you did not comply with any provisions of these Terms, you have by your acts or omissions (whether directly or indirectly) caused or contributed to the occurrence of the unauthorised transaction, the transaction was carried out with your knowledge, intention or consent, or you acted fraudulently or dishonestly (whether alone or with others).

In any event, we shall not be liable for any Loss that is an indirect or consequential loss, or any lost profits, earnings, business, goodwill or opportunity, even if such Loss is foreseeable.

15.2 We are not responsible or liable for the acts of any third party, including the acts of any third party involved in the provision of services or products to you, or the acts of any third party service providers, contractors or agents engaged by the Bank and their sub-contractors or further indirect sub-contractors or the insolvency or bankruptcy of any such third party, and we will not be liable for any Loss that you may incur as a result of the acts of any such third party, unless such Loss is caused by our gross negligence, wilful misconduct or fraud.

15.3 We are not responsible for any decision you make to obtain our services or products or to enter into these Terms, and any such decision is your own decision based on your independent judgment. If you need any advice, you should seek advice from your own independent advisers.

15.4 We are not responsible or liable for any acts or representations of our employees or agents that are made without our authority.

15.5 This Clause A15 (Liabilities) shall survive the termination of these Terms.

16.1 You agree, on a continuing basis, to indemnify the Bank, and pay and reimburse the Bank, for all and any Losses that the Bank may incur in connection with or arising from our provision of services or products to you, except where such Loss is caused by our gross negligence, wilful misconduct or fraud.

16.2 This Clause A16 (Indemnities) shall survive the termination of these Terms.

17.1 The Bank shall not be responsible or liable for any Loss which you may incur where such Loss arises from any event or circumstance that is not reasonably within our control, regardless of the duration of such event or circumstance. Such events include earthquakes, fires, floods, storms, pandemics, natural disasters or other acts of God, wars, acts of terrorism, military action, riots, civil unrest or other disturbances, strikes, industrial disputes or other industrial actions, imposition of currency exchange controls or restrictions, embargoes, changes to laws and regulations or other governmental action, mechanical errors or malfunctions in any machines or systems, sabotage, fluctuations or failures in power supply or telecommunication networks, disruptions to the Internet, computer viruses, or the failure of any financial market infrastructure.

18.1 You may terminate these Terms or any service or product provided by the Bank and close your

account by giving the Bank notice in writing, provided that you do not owe any outstanding amount to the Bank or have any outstanding liabilities to the Bank.

18.2 The Bank may terminate these Terms or the provision of any service or product to you and close your account by giving you reasonable notice in writing.

18.3 In addition, the Bank shall have the right to terminate these Terms or the provision of any service or product to you and close your account, with immediate effect and without any notice to you if any of the following Events of Default occur:

- you do not make any payment that is due to us;

- you breach any of your obligations under these Terms;

- you do not provide any information or documents requested by us;

- any representation or warranty in Clause A7.1 is not true or accurate or is no longer true or accurate;

- you have a zero or negative balance in your account;

- you are, or are likely to become, insolvent or bankrupt, or any insolvency or bankruptcy proceedings are commenced against you;

- you are, or are likely to be, unable to fulfil any of your financial obligations to any person, including third parties;

- your assets are subject to enforcement proceedings in any jurisdiction;

- you are the subject of any civil, criminal, investigation or disciplinary proceedings in any jurisdiction or any such proceedings are threatened against you or disciplinary proceedings in any jurisdiction;

- you commit or are convicted of any criminal offence in any jurisdiction, or you are found to be fraudulent or dishonest in any proceedings;

- we reasonably suspect that you are involved in any unlawful activity, including any breach of Applicable Law (including any Applicable Law relating to anti-money laundering, countering the financing of terrorism or sanctions);

- in our opinion, any account, product or service provided by the Bank is not being used in a lawful, proper or regular manner;

- it becomes unlawful for you to perform any of your obligations under these Terms or any relevant transaction document with the Bank or any of your obligations under these Terms or any transaction document with the Bank ceases to be legal, valid, binding or enforceable;

- we are required under Applicable Law, by any court order or direction from any regulator to do so or we would otherwise breach any Applicable Law or agreement with a third party; or

- the occurrence of any Event of Default under any Specific Terms or any event of default or any similar event under any other terms and conditions governing the provision of any services or products by the Bank to you.

18.4 If you wish to terminate these Terms or close your account with the Bank under Clause A18.1, you shall transfer all funds out from your account with the Bank, and as the case may be, repay all outstanding amounts and liabilities due to the Bank and/or comply with any other reasonable procedures or requests of the Bank (including closure of any other account with the Bank) before the termination or account closure is effective.

18.5 Upon the termination of these Terms or the closure of your account with the Bank, any amount that you owe to us shall immediately become due and payable.

18.6 If these Terms are terminated or your account is closed for any reason and you do not transfer all funds out from your account, we may proceed to exercise our rights of set-off and consolidation under Clause A13 (Right of Set-Off and Lien) and pay you the net balance in your account by any means in our discretion, and you agree that this shall be a full discharge of the Bank’s liabilities to you in respect of your account and these Terms, and you waive any and all rights or claims you may have against the Bank under these Terms.

18.7 Termination of these Terms do not affect any rights or obligations of any party that arose before the termination, or any liabilities that accrued before the termination.

18.8 This Clause A18 (Account Closure and Termination) shall survive the termination of these Terms.

19.1 You shall provide the Bank with your residential address, Singapore telephone number, e-mail address or any other contact information at which we may contact you, and send you notices and communications. Your residential address may be used by the Bank as your mailing address. We may also provide your residential address, Singapore telephone number, e-mail address or any other contact information to any government authority, regulator, enforcement agency, tax authority, court, tribunal or judicial body if we are required to do so. You must immediately inform us of any change to your contact information.

19.2 The Bank may publish certain notices or communications to you on our website or mobile application. You should check our website or mobile application regularly for notices or communications.

19.3 Any notice or communication that the Bank sends to you will be deemed to be delivered and effective:

- if sent in person, at the time of delivery;

- if sent by post to an address in Singapore, on the second Business Day following the date of posting;

- if sent by post to an address outside Singapore, on the fifth Business Day following the date of posting;

- if sent by SMS or e-mail, at the time of delivery, unless we receive a message delivery failure receipt;

- if sent by push notification through our mobile application, at the time of delivery; and

- if published on our website or mobile application, at the time of publication.

19.4 Notices or communications that you send to the Bank will be deemed to be delivered and effective only when we receive them.

20.1 The Bank may amend any or all of these Terms (including our fees and charges) at any time. We may make such amendments because of changes in the way we provide you with services or products, or other changes in our operations or business, to introduce new features, services or products, because of changes to Applicable Law or to clarify the meaning of these Terms. The Bank will notify you of any amendment. Such amendment will take effect on the date we specify in the notice to you. The Bank may introduce additional terms and conditions governing new features, services or products without giving you any advance notice. Nonetheless, we will use reasonable endeavours to provide you with 30 days' advance notice for any amendment relating to our fees and charges and your liabilities or obligations, unless the amendment is clarificatory in nature, required for compliance with Applicable Law (which may take effect immediately) or time sensitive, or it is not practicable to do so.

20.2 The Bank may introduce additional Specific Terms that apply to the provision of new services or products without giving you any advance notice. Any such Specific Terms will take effect from the date we agree to provide you with the relevant new service or product.

20.3 If you continue to use any service or product provided by the Bank to you after having been notified of amendments to these Terms, you are deemed to have agreed to and accepted the amendments. If you do not accept any such amendments, you must discontinue your use of the Bank’s services or products and terminate your banking relationship with us with respect to such relevant service or product in accordance with these Terms.

21.1 The Bank is entitled to assign or transfer any or all of our rights or obligations under these Terms to any person without notice to you and without your consent.

21.2 You may not assign or transfer any part of your rights or obligations under these Terms without our prior written consent.

22.1 A third party who is not a party to these Terms shall have no rights under the Contracts (Rights of Third Parties) Act 2001 of Singapore to enforce or enjoy the benefit of any provision of these Terms.

23.1 A failure or delay by the Bank in exercising or enforcing any power or right under these Terms, or in enforcing compliance with any provision of these Terms, shall not operate as a waiver or release by the Bank, and the Bank is not prevented from exercising or enforcing any such power or right.

24.1 If any provision of these Terms is, or becomes, illegal or otherwise invalid or unenforceable in any way, such illegality, invalidity or unenforceability shall not in any way affect or impair any other provision of these Terms, and these Terms shall be interpreted as if such illegal, invalid or unenforceable provision was varied so that it is legal, valid and enforceable or as if such illegal, invalid or unenforceable provision was not part of these Terms.

25.1 These Terms set out the entire contractual agreement between the Bank and you in connection with the provision of services or products by the Bank to you. These Terms supersede any other agreement, understanding, notice, statement or representation, whether oral or written, in relation to any services or products of the Bank.

26.1 These Terms shall be governed by and interpreted in accordance with Singapore law.

26.2 You agree to submit to the exclusive jurisdiction of the Singapore courts. You may only bring an action or proceeding against the Bank in the Singapore courts. The Bank may bring an action or proceeding against you in the courts of any jurisdiction, including any jurisdiction where you may be resident or where you may own assets.

27.1 Any originating claim, statement of claim, originating application or any other notice or document relating to legal proceedings shall be deemed to be sufficiently served on you if sent in person or by post to your last known address in our records.

27.2 Nothing in this Clause A27 (Service of Legal Process or Documents) shall affect or limit our rights to serve any legal process or documents on you in any other manner allowed under Applicable Law.

28.1 The table below sets out the meaning of the following capitalised words when used in these

Terms.

“Applicable Law”

means any and all applicable laws, regulations, guidelines, codes or rules, including industry guidelines, codes or rules, whether in Singapore or elsewhere, and whether having the force of law, as amended, modified, varied or re-enacted from time to time.

“Business Day”

means any day on which banks in Singapore are generally open for business.

“Customer Information”

means any information relating to you, including your Personal Data and other personal information, and information on your accounts and transactions, that the Bank has in connection with the provision of services or products to you.

“Data Privacy Policy”

means our data privacy policy as (i) set out at the following URL: www.gxs.com.sg/data-privacy, or (ii) made available through our mobile application.

“Event of Default”

means any event that gives the Bank the right to terminate these Terms or the provision of any service or product to you under Clause A18 (Account Closure and Termination), any Specific Terms or otherwise.

"high-risk activities"

include, but are not limited to (a) adding of payees to the your payment profile; (b) increasing the transaction limits for outgoing payment transactions from the payment account; (c) disabling Notifications that the Bank will send upon completion of a payment transaction; and (d) change in your contact information including telephone number, mailing address, e-mail address or any other contact information at which we may contact you.

“Loss”

means any losses, damages, costs (including legal costs on a full indemnity basis), expenses, liabilities, taxes, charges, suits, proceedings, actions, claims, any other demands or remedies of any kind, whatsoever and however caused, whether arising under contract, tort or otherwise, and including any lost profits, earnings, business, goodwill or opportunity, any costs or expenses incurred to protect or enforce legal rights, whether or not foreseeable, and whether direct, indirect or consequential.

“Notifications”

shall have the meaning defined in Clause A3.1.

“Personal Data”

means any information (whether true or not) which identifies or that relates to an individual.

“PIN”

means the personal identification number for any service or product provided by the Bank.

“Related Entity”

in relation to an entity, means any holding company, subsidiary, affiliate, related corporation or other related entity of the first entity.

“Statements”

shall have the meaning defined in Clause A3.1.

"unauthorised transaction"

means any payment transaction initiated from your account by any person without your actual or imputed knowledge and implied or express consent, and includes any payment transaction initiated from your account using your password, PIN or authentication code whereby your account credentials, password, PIN or authentication code was fraudulently obtained from you (including via any impersonation of a legitimate business or government entity through a fabricated digital platform or otherwise), and which you did not intend to perform.

28.2 In these Terms, unless the context requires otherwise:

- the headings shall be ignored in interpreting the provisions of these Terms;

- any reference to a Clause shall be to a Clause of these Terms – references to a Clause number prefixed bythe Section number shall be a reference to a Clause in that Section (e.g.Clause A1 refers to Clause 1 of Section A);

- any reference to “you” shall include the individual in whose name an account is maintained with the Bank, the individual offered a product or service by the Bank, and (as the context may require) any legal representative or Authorised Person.

- any reference to a person shall include body corporates, unincorporated associations, partnerships, trusts and other bodies of persons;

- the word “includes” or “including” shall be understood to mean “includes without limitation” or “including without limitation”;

- any reference to actions or acts shall include failures to act; and

- any reference to any statute, regulation, guidelines, code or rules shall be a reference to such statute, regulation, guidelines, code or rules as may be amended, modified, varied or re-enacted from time to time.

B. Debit Card

When you open a savings account with the Bank, you also agree to the applicable terms and conditions governing debit card (including debit card rewards). You may at any time while maintaining a savings account with the Bank create a virtual debit card that is linked to your savings account. You may also request for a physical debit card that is linked to your savings account.

This Section B (Debit Card) sets out the terms and conditions on which the Bank provides you with debit cards.

Our provision of, and your use of, the savings account will be on the terms and conditions in the applicable terms and conditions governing savings accounts.

1.1 You agree to follow the procedures that we prescribe for creating and activating the virtual debit card that the Bank issues to you. Your virtual debit card will be automatically activated when it is created.

1.2 Your virtual debit card will have a card number and a card security code, and may be used for online transactions, contactless transactions through an application, and other transactions as may be determined by the Bank from time to time.

1.3 When any virtual debit card transaction is made using your card security code or is authenticated by transaction signing or any form of additional confirmation, you agree that such use of your card security code, or such transaction signing or additional confirmation is evidence that the virtual debit card transaction is authorised by you.

1.4 Upon termination of these Terms, your savings account or cancellation of your debit card, you shall immediately stop using your debit card via any means.

2.1 The Bank may provide you with a physical debit card at your request. Your physical debit card will have the same card number and card security code as your virtual debit card. You agree to follow the procedures for activating the physical debit card that the Bank issues to you.

2.2 Your physical debit card may be used for point of sale transactions, contactless transactions and other transactions as the Bank may make available to you.

2.3 The physical debit card is, and remains, the property of the Bank. You shall ensure that the physical debit card is not damaged in any way. We may, at your request, agree to replace the physical debit card. If we replace your physical debit card, we will also replace your virtual debit card at the same time.

2.4 The Bank may send your physical debit card to you by post, and you accept and agree to bear the risks from us doing so, including the risks of the physical debit card being lost. The Bank will not be responsible or liable from any Loss that may arise from us sending your physical debit card to you by post, unless such Loss is caused by our gross negligence, wilful misconduct or fraud.

2.5 When any physical debit card transaction is made using your PIN or is otherwise authenticated by your signature on a charge slip or other record of the transaction, you agree that such use of your PIN or such authentication is evidence that the physical debit card transaction is authorised by you.

2.6 Upon termination of these Terms, your savings account or cancellation of your debit card, you shall immediately stop using your debit card via any means, cut your physical debit card in half, and securely dispose of your physical debit card.

3.1 When you make any debit card transaction, the Bank will process the transaction by debiting the corresponding amount from the Main Account of your savings account. You authorise the Bank to process the debit card transaction by debiting the corresponding amount from the Main Account of your savings account.

3.2 You may make a debit card transaction only if there is sufficient credit balance in the Main Account of your savings account. Notwithstanding this, the Bank shall have the right to process any debit card transaction that results in the credit balance in the Main Account of your savings account becoming negative. Any such processing by the Bank only applies for that particular debit card transaction, and does not mean that we will process a similar transaction where there is insufficient credit balance in the future. The overdrawn amount or amount of the negative balance shall be a debt owing by you to the Bank, but shall not constitute a line of credit or other loan, and the Bank shall have the right to charge you interest on the overdrawn amount or amount of the negative balance at a rate determined by the Bank and notified to you, and to impose an administrative charge.

3.3. When we are informed by a merchant, a card association or any other person that a debit card transaction has been submitted for your debit card, the Bank may place a hold on or set aside an amount estimated by the Bank to be the value of your debit card transaction in your savings account. You will not be able to use such amount that has been held or set aside for funds transfers, other debit card transactions or any other purpose. Such amount may not be the exact amount for which that debit card transaction is effected and finally debited from your account.

4.1 The Bank may impose limits on the value of each debit card transaction or the aggregate daily value of debit card transactions that you may make. We will notify you of any such limits.

4.2 You may set limits on the aggregate daily value of debit card transactions that can be made using your debit card.

4.3 The Bank shall have the right to not process any of your debit card transactions in accordance with Clause A2.8 (Instructions) and Clause B12 (Rights of the Bank).

5.1 You are responsible for safeguarding the confidentiality of your debit card, card number and card security code. If you know or suspect that your debit card, card number or card security code has been compromised, you must immediately inform the Bank.

5.2 You are responsible for keeping your smartphone or other device used to access the debit card services and physical debit card secure, and you shall ensure that your smartphone, other device or physical debit card is not lost or misplaced. If your smartphone, other device or physical debit card is lost or misplaced or you suspect that it is lost or misplaced, you must immediately inform the Bank.

5.3 You are required to choose your PIN when applying for a debit card. You must not permit any other person to use your virtual debit card or physical debit card, or disclose the PIN for your physical debit card to any person. You must safeguard the confidentiality of your PIN and not keep a record of your PIN in any matter that enables another person to misuse your PIN. If you know or suspect that your card or PIN has been compromised, you must immediately change your PIN and notify the Bank.

5.4 You agree that when your debit card is used for any transaction, it is deemed to be used with your authority and knowledge, and you authorise us to debit the corresponding amount from your savings account. You agree that our records of transactions made using your debit card are correct and conclusive evidence of such transactions.

5.5. If you inform us that your card number, card security code or PIN has been compromised, or your smartphone, other device or physical debit card has been lost, misplaced or stolen, you will not be liable for any debit card transaction that is made after you so inform us. You are liable for any unauthorised transactions that may be made using your debit card before you so inform us, except that your liability for such unauthorised transactions shall be limited to S$100 if you co-operate with us in our investigations into the unauthorised transactions, including providing any information, document, authentication or confirmation requested by us, and we are satisfied in our discretion that the unauthorised transactions were not due to your fraud, gross negligence or default and that you had immediately informed us upon becoming aware that your card number, card security code or PIN has been compromised, or your smartphone, other device or physical debit card was lost, misplaced or stolen.

5.6 When you receive a transaction notification alert from us, you must immediately check the details in the transaction notification alert. If there are any errors or if the transaction is not authorised by you, you must immediately inform us. You agree to provide us with any information that we reasonably request to facilitate our investigations into the transaction, and to make a police report if we reasonably request such a report to be made to facilitate the claims investigation process. If there is any delay in your informing us of the error or the unauthorised transaction, you must explain to us the reasons for such delay.

5.7 If you dispute any transaction, you must inform us immediately in the manner specified. We may credit your savings account with the amount of the disputed transaction after completing our investigations.

6.1 Contactless transactions do not require the magnetic stripe of your physical debit card to be swiped at, or the chip of your physical debit card to be read by, a point of sale terminal, or your signature or PIN to authorise the transaction.

6.2 Contactless transactions may be subject to transaction limits set under Applicable Law(including the rules of the card associations) or by the Bank. Any transaction limits for contactless transactions set by the Bank will be notified to you. For contactless transactions in excess of such transaction limits, you may be required to use your physical debit card.

7.1 If you use your debit card for any transaction denominated in a currency other than Singapore dollars, the transaction amount will be converted into Singapore dollars by the card association at the prevailing foreign exchange rate as determined by the card association, and we will debit the Singapore dollar amount notified to us by the card association from the Main Account of your savings account. The Singapore dollar amount notified to us by the card association may include any fees or charges imposed by the card association. In addition, if we incur any costs or expenses in processing such foreign currency transactions, you agree to pay us for such costs or expenses.

8.1 Dynamic Currency Conversion may be available for transactions (including point of sale transactions and other transactions that the Bank may make available to you) outsideSingapore. Dynamic Currency Conversion is a service that converts a transaction denominated in a currency other than Singapore dollars into a transaction denominated into Singapore dollars, at an exchange rate determined by the merchant or other service provider. An overseas or online merchant or other service provider may therefore offer you a Singapore dollar rate for transactions. Transactions using your debit card where Dynamic Currency Conversion is applied are subject to additional charges (including any fees or charges imposed by the card associations) as may be notified to you in accordance with Clause A4 (Fees and Charges), and you agree to pay us such additional charges.

8.2 While certain merchants (for example merchants who enter into transactions with you through a website or mobile application) may offer you a Singapore dollar rate for transactions, such transactions may be routed by the merchant for processing through an overseas intermediary, or the merchant may be registered by its acquiring bank as having been acquired overseas. Such transactions may therefore be transactions denominated in foreign currencies, and converted into and presented to you as transactions denominated into Singapore dollars, at an exchange rate determined by the relevant overseas intermediary or acquiring bank. Such transactions will be subject to additional charges (including any fees or charges imposed by the card associations) as may be notified to you in accordance with Clause A4 (Fees and Charges),and you agree to pay us such additional charges.

9.1 If you wish to use your physical debit card outside Singapore for point of sale transactions, contactless transactions or other transactions which the Bank may make available to you, you must first enable your physical debit card for overseas use. The magnetic stripe of your physical debit card can be swiped at, or the chip of your physical debit card can be read by, a point of sale terminal to authorise the transaction overseas.

9.2 The debit card transactions that you make outside Singapore will be denominated in the currency of the foreign country, and we will convert the transaction amount into Singapore dollars and debit the equivalent Singapore dollar amount from the Main Account of your savings account in accordance with Clauses A12 (Foreign Currencies) and B7 (Transactions in Foreign Currencies). We will charge you an administrative fee, as notified to you from time to time in accordance with Clause A4 (Fees and Charges), for each debit card transaction that you make outside Singapore. In addition, you agree to pay for any charges that may be imposed by the card associations for any such debit card transaction made outside Singapore.

10.1 You may add your virtual debit card to a Digital Wallet provided by a third party, as may be approved by the Bank. The Bank will notify you of the third party Digital Wallets that you are allowed to add your virtual debit card to.

10.2 You agree and consent to the Bank disclosing your Customer Information to the third party Digital Wallet provider that you add your virtual debit card to, and any other third parties as may be necessary, for the purposes of and in connection with enabling you to add your virtual debit card to the third party Digital Wallet.

10.3 Your use of the virtual debit card through a Digital Wallet will be subject to separate terms and conditions between you and the third party Digital Wallet provider that governs the provision of the Digital Wallet service to you, and the procedures prescribed by the third party Digital Wallet provider.

10.4 If you add your virtual debit card to a Digital Wallet, you shall be responsible for keeping the smartphone or other device on which the Digital Wallet is installed secure, and you shall ensure that your smartphone or other device is not lost or misplaced. You must not allow anyone else to use or access the smartphone or other device on which the Digital Wallet is installed. You must choose a strong password for your smartphone or other device. You must delete your virtual debit card from the Digital Wallet before you dispose of, or allow anyone else to temporarily access, your smartphone or other device.

10.5 The Bank may impose limits on the value of transactions that you may make through a Digital Wallet. We will notify you of any such limits.

10.6 The use of your virtual debit card through a Digital Wallet may involve other charges and expenses, including data usage fees. You are solely responsible for paying for such other charges and expenses.

10.7 The Bank shall not be responsible or liable for any Loss that you may incur arising from your use of your virtual debit card through a Digital Wallet, unless such Loss is caused by our gross negligence, wilful misconduct or fraud. In addition, the Bank is not responsible or liable for any actions of any third party Digital Wallet provider.

11.1 You will not be able to withdraw cash through any ATM in or outside Singapore using your debit card.

12.1 The Bank shall have the right to not approve, process or effect any transaction you attempt to make using your debit card, without prior notice to you and without giving you any reason.

12.2 The Bank shall have the right to suspend or withdraw your right to use the debit card at anytime without prior notice to you and without giving you any reason.

12.3 The Bank is not responsible or liable for the acts of any third party involved in the processing of debit card transactions, including the acts of any card association or any payment intermediary.

12.4 The Bank shall not be responsible or liable for any Loss that you may incur from or in connection with your use of your debit card, including if:

- we, any merchant, any other bank or financial institution, any card association or any person refuses to accept your debit card or to process any transaction made using your debit card;

- a debit card transaction is not able to be completed because your debit card or PIN is rejected by a point of sale terminal or for any other reason;

- we place a hold on or set aside any amount in your savings account;

- there is any unauthorised use of your debit card;

- we refuse to approve, process or effect any transaction you attempt to make using your debit card;

- we suspend or withdraw your right to use the debit card;

- we are unable to process any debit card transaction because of an event or circumstance that is not reasonably within our control, including if there is any failure in any transmission system or any event or circumstance set out in Clause A17 (Events Outside Our Control); or

- there is any damage to or loss of or inability to retrieve any data or information that maybe stored in your debit card.

12.5 The Bank may offer or make available to you rewards, discounts or other benefits for your use of the debit card, or may partner with or introduce you to merchants who offer or make available to you such rewards, discounts or other benefits. Any such rewards, discounts or other benefits will be subject to a set of separate terms and conditions governing such rewards, discounts or other benefits. You acknowledge and agree that using your debit card means agreeing to participating in applicable rewards, discounts or other benefits, and you shall be bound by such terms and conditions governing the rewards, discounts or other benefits as may be relevant.Where such rewards, discounts or other benefits are offered by such merchants or other persons, the Bank is not responsible or liable for the acts of any such merchants or other persons, or for any rewards, discounts or other benefits that are offered by such merchants or other persons.

13.1 You may temporarily freeze the use of your debit card at any time through the procedures specified by the Bank. Once the temporary freeze takes effect in accordance with the procedures specified by the Bank, we will not process any new transactions made using your debit card (whether your physical debit card, virtual debit card or any other means).

13.2 You may cancel the temporary freeze and re-activate your debit card for use through the procedures specified by the Bank.

13.3 The Bank is not responsible or liable for any Loss that you may incur as a result of the temporary freeze or re-activation of your debit card (including any time taken for the re-activation of your debit card).

14.1 The Bank is not responsible or liable for any goods or services that you may purchase from an individual, a merchant or other third party provider using your debit card, or the quality of any such goods or services. We are entitled to debit your savings account for the transaction amount, even if you do not receive the goods or services from the individual, merchant or third party provider, or the goods or services are not of satisfactory quality. If you do not receive the goods or services or the goods or services are not of satisfactory quality, you must approach the individual, merchant or other third party provider directly if you wish to seek recourse from them. Any dispute between you and the individual, merchant or other third party provider does not affect in any way your liability to us for the transaction amount, and you agree that we are entitled to debit the transaction amount in full from your savings account.

15.1 The table below sets out the meaning of the following capitalised words when used in this Section B (Debit Cards).

“ATM” means automated teller machine.

"Digital Wallet" means a digital wallet provided by a third party through an application installed on a smartphone or other device or through other means (e.g. Google Pay).

C. GXS FlexiCard

When you apply for the FlexiCard, you also agree to the applicable terms and conditions governing the FlexiCard (including FlexiCard rewards). This Section C (GXS FlexiCard) sets out the terms and conditions on which the Bank provides you the FlexiCard and is to be read together with Section A (General Terms and Conditions) which together shall constitute the GXS FlexiCard Terms or Terms.

1.1 You agree to follow the procedures that we prescribe for creating and activating the virtual FlexiCard that the Bank issues to you. Your virtual FlexiCard will be automatically activated when it is created.

1.2 Your virtual FlexiCard will have a card number and a card security code, and may be used for online transactions, contactless transactions through an application, and other transactions as may be determined by the Bank from time to time.

1.3 When any virtual FlexiCard transaction is made using your card security code or is authenticated by transaction signing or any form of additional confirmation, you agree that such use of your card security code, or such transaction signing or additional confirmation is evidence that the virtual FlexiCard transaction is authorised by you.

1.4 Upon termination of these Terms, closure of your FlexiCard account or cancellation of your FlexiCard, you shall immediately stop using your FlexiCard via any means.

2.1 A physical FlexiCard will also be sent to you by post after your first virtual FlexiCard has been created. Your physical FlexiCard will have the same card number and card security code as your virtual FlexiCard. You agree to follow the procedures for activating the physical FlexiCard that the Bank issues to you.

2.2 Your physical FlexiCard may be used for point of sale transactions, contactless transactions and other transactions as the Bank may make available to you.

2.3 The physical FlexiCard is, and remains, the property of the Bank. You shall ensure that the physical FlexiCard is not damaged in any way. We may, at your request, agree to replace the physical FlexiCard, subject to a Card Replacement Fee in accordance with Clause C13.4 (Fees and Charges). If we replace your physical FlexiCard, we will also replace your virtual FlexiCard at the same time. In the event your virtual FlexiCard is cancelled or replaced, you may choose not to reorder a new physical FlexiCard.

2.4 The Bank may send your physical FlexiCard to you by post, and you accept and agree to bear the risks from us doing so, including the risks of the physical FlexiCard being lost. The Bank will not be responsible or liable from any Loss that may arise from us sending your physical FlexiCard to you by post, unless such Loss is caused by our gross negligence, wilful misconduct or fraud.

2.5 When any physical FlexiCard transaction is made using your PIN or is otherwise authenticated by your signature on a charge slip or other record of the transaction, you agree that such use of your PIN or such authentication is evidence that the physical FlexiCard transaction is authorised by you.

2.6 Upon termination of these Terms, closure of your FlexiCard account, or cancellation of your FlexiCard, you shall immediately stop using your FlexiCard via any means, cut your physical FlexiCard in half, and securely dispose of your physical FlexiCard.

3.1 Your use of the FlexiCard is subject to the Credit Limit. You may not initiate or authorise a transaction that will result in the total outstanding balance under your FlexiCard exceeding the Credit Limit.

3.2 Without prejudice to the aforesaid, we may in our absolute discretion allow or approve certain FlexiCard transactions and impose such fees and charges, even if such action will result in the total outstanding balance under your FlexiCard exceeding the Credit Limit. In calculating whether the Credit Limit has been exceeded, we may take into account the amount of any FlexiCard transaction which has been authorised but not debited and any other matter we think is relevant.

3.3 Without prejudice to Clause C3.1 (Credit Limits), if you carry out any FlexiCard transaction which results in the Credit Limit being exceeded (with or without our prior consent) you must immediately pay us the amount in excess of the Credit Limit. We reserve the right, without prejudice to any of our other rights or remedies, to terminate your FlexiCard and close your FlexiCard account with or without notice to you.

3.4 If you are an existing customer of the Bank or any of our Related Entities, your FlexiCard Credit Limit may constitute part of the maximum credit limit permitted by the Bank and any of our Related Entities, including under any existing credit products, credit facilities and/or credit arrangements extended to you by the Bank and any of our Related Entities.

3.5 The Bank may impose limits on the value of each FlexiCard transaction or the aggregate daily value of FlexiCard transactions that you may make. We will notify you of any such limits.

3.6 You may set limits on the aggregate daily value of FlexiCard transactions that can be made using your FlexiCard.

3.7 The Bank shall have the right to not process any of your FlexiCard transactions in accordance with Clause A2.8 (Instructions) and Clause C15 (Rights of the Bank).

4.1 You are responsible for safeguarding the confidentiality of your FlexiCard, FlexiCard number and FlexiCard security code. If you know or suspect that your FlexiCard, FlexiCard number or FlexiCard security code has been compromised, you must immediately inform the Bank.

4.2 You are responsible for keeping your smartphone or other device used to access the FlexiCard services and physical FlexiCard secure, and you shall ensure that your smartphone, other device or physical FlexiCard is not lost or misplaced. If your smartphone, other device or physical FlexiCard is lost or misplaced or you suspect that it is lost or misplaced, you must immediately inform the Bank.

4.3 You are required to choose your PIN when applying for a FlexiCard. You must not permit any other person to use your virtual FlexiCard or physical FlexiCard, or disclose the PIN for your physical FlexiCard to any person. You must safeguard the confidentiality of your PIN and not keep a record of your PIN in any matter that enables another person to misuse your PIN. If you know or suspect that your card or PIN has been compromised, you must immediately change your PIN and notify the Bank.

4.4 You agree that when your FlexiCard is used for any transaction, it is deemed to be used with your authority and knowledge, and you authorise us to debit the corresponding amount to your FlexiCard and that such transactions are binding on you. You agree that our records of transactions made using your FlexiCard are correct and conclusive evidence of such transactions and shall be binding on you.