Underserved consumers are lukewarm about their potential to progress financially: GXS

SINGAPORE, 11 July 2024 – Gig economy workers, entrepreneurs and the next generation of working adults are lukewarm about their potential to progress financially, according to the GXS Progress Quotient 2024.

These individuals are part of a segment that GXS Bank (GXS) defines as financially underserved, given the challenges that they typically face in accessing relevant banking products.

The GXS Progress Quotient 2024 is a survey commissioned by GXS which seeks to understand the relationship that Singapore consumers have with their money and how that affects the way they view their financial progress.

Out of a score of 10, underserved consumers have a GXS Progress Quotient (GPQ) score of 5.1. The GPQ is an index that provides a measurement to track an individual’s perceived potential for progress. It is derived from four metrics:

- An individual’s financial decision-making behaviours

- Their perceived financial progress at present, compared with the past

- Their expected financial progress in the future, compared with the present

- Their emotions when making financial decisions

GXS Group CEO, Mr Muthukrishnan Ramaswami, said, “What is our relationship with money? That’s what we seek to understand to bring better banking to consumers. Through the GXS Progress Quotient 2024, we have a benchmark on how consumers in Singapore relate to their money which we will continue to track in future editions. In our first year, we have already gleaned insights from the research that we are using to shape the GXS experience for our customers, such as using financial literacy to help alleviate the anxiety they may experience in their financial journey. Our hope is that we will be able to play a part, along with like-minded partners and peers, to improve the GPQ score of our customers in the coming years.”

Negative emotions are amplified within the underserved segment

The GXS Progress Quotient 2024 found that respondents in general displayed conflicting emotions in their relationship with money, with stress (32%) and anxiety (27%) sharing the podium with optimism (28%).

These negative emotions are amplified among underserved consumers. In particular, more self-employed individuals such as gig economy workers felt stress (43%) and anxiety (41%) in their relationship with money. Meanwhile, Gen Zs and early-jobbers were less optimistic (23%) about their financial progress compared with the benchmark.

Consumers who are self-employed or early-jobbers also rate access to education (51%), luck (42%) and relevant banking products for them (33%) as the top drivers that can help improve their financial progress.

Ms Char Ong, sales manager for a construction firm and one of the respondents surveyed said that she is lukewarm about her potential to progress financially because of the limited benefits she has experienced with banks.

“With the rate of inflation and the cost of living increasing faster than the rate of my earnings, it’s important to keep pace. To get out of this rat race where we need to keep working just to keep up, banks should think about how they can help their customers grow their passive income.”

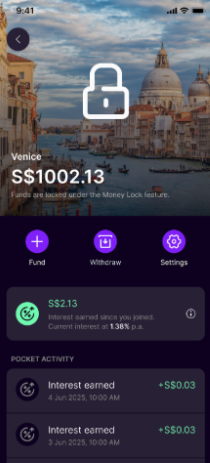

Ms Jenn Ong, Head of Retail, GXS, said, “It is not a coincidence that segments which have traditionally been underserved by financial services say that access to financial education and relevant banking products can help them to manage their finances better. While we cannot sway their luck, at GXS we have made it a focus from day one to design banking products that make sense for them, even if it means challenging common market practices such as crediting interest daily on their savings so they can benefit from compounding every single day.”

Survey methodology and scope

The GXS Progress Quotient 2024 surveyed 1,300 Singaporeans and permanent residents aged 15 to 59 in Singapore, of which 300 respondents were early-jobbers under the age of 35, gig economy workers and entrepreneurs to ensure these segments were demographically represented.

Utilising insights from the research findings, the GPQ was developed to measure an individual’s perceived potential for financial progress. The index is a score between 0 to 10, with higher scores indicating greater confidence.

The GXS Progress Quotient 2024 is available at https://www.gxs.com.sg/gxspq2024.

-END-

About GXS Bank

GXS Bank (GXS) is a digital bank with a relentless focus to make banking better for the everyday consumer and small business. This includes Singapore’s underserved individuals and businesses.

The Bank aims to improve financial inclusion and to drive financial revolution for its customers through the secure and ethical use of technology and data.

GXS holds a banking licence issued by the Monetary Authority of Singapore.

It is backed by a consortium consisting of Grab Holdings Inc. – Southeast Asia’s leading super app, and Singtel – Asia’s leading communications technology group. GXS is a separate entity and is not associated with the businesses of Grab Holdings, Singtel and their entities.

For media enquiries, please contact:

comms@gxs.com.sg